|

|

|

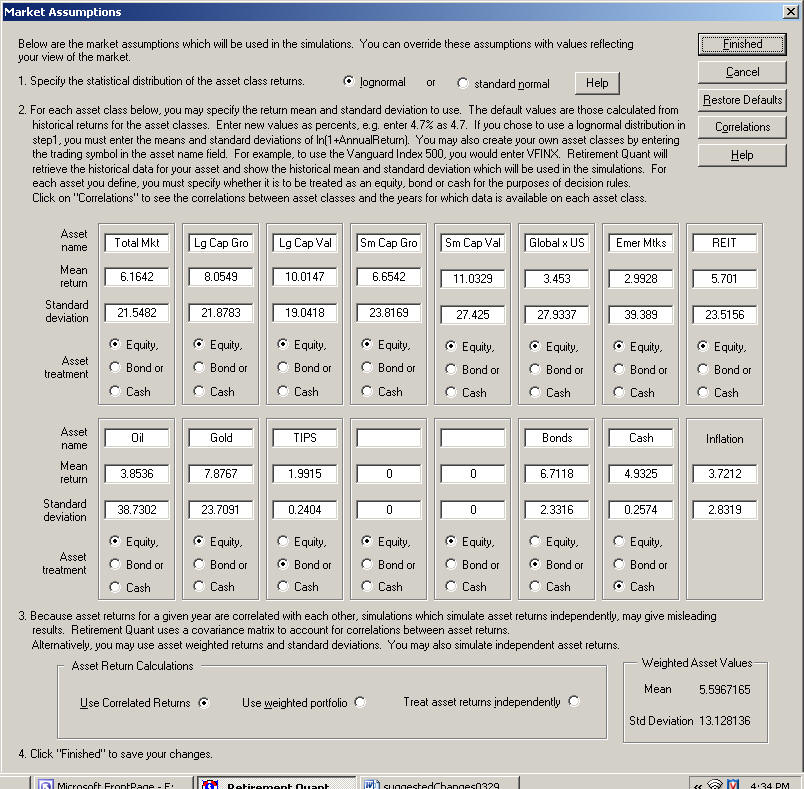

This window allows you to define and customize the assets that are simulated. For each asset type, you have the option to specify the mean and standard deviation of the asset returns. You can use the defaults based upon historical data or use your own values. In addition, you can add investments of your own or replace the pre-defined asset classes. This allows you the ability to model specific portfolios. With the Professional Edition, you can specify the market assumptions on a client by client basis. You can also view the correlations between the asset classes and investments.

|

||||||

| Approach | ||||||

| Notes | ||||||

| How it Works | ||||||

| Sample Profiles | ||||||

| In the News | ||||||

| How to Order | ||||||

| Publications | ||||||

| Management | ||||||

| FAQ | ||||||

| r | ||||||

|

© 2016, All Rights Reserved |

Retirement

Quant™