Getting Started

Go to the Start menu and

select Retirement

Quant.

Go to the Start menu and

select Retirement

Quant.

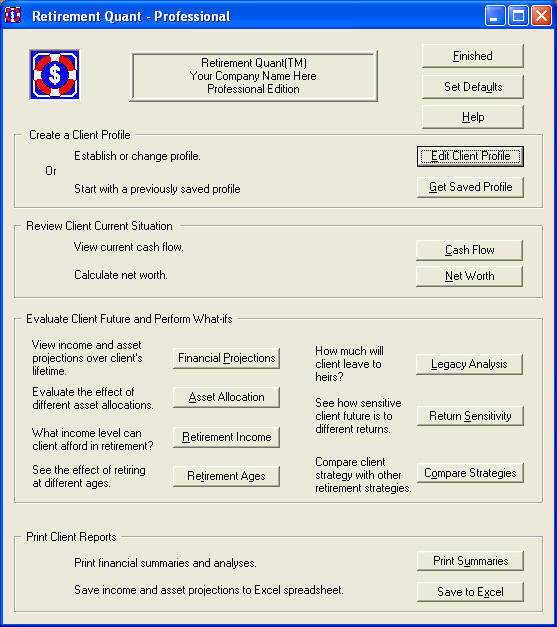

Before you run simulations, you must enter your financial data. This is done by clicking on the "Edit Profile" button. Then click on each of the buttons in the Edit/Create Profile dialog box and enter your data. In each dialog box, click "Finished" when you have entered all the information.

In the Retirement Strategies dialog box, enter the retirement income you desire. Note that this can be different than your current income. You must also enter the year in which you wish to start having your retirement income. That year does not have to be the year you stop working. If the year when you wish to have the specified retirement income is earlier than when you finish working, then that will be your target income level and if your current income does not achieve that level, then the simulator will start to withdraw from your assets to achieve that level. This is useful feature if you take a part-time job in retirement.

It is recommended that you do not initially enter other data or select decision rules in the Retirement Strategies dialog box. First, see the results of the analysis of your current financial plan using the various Retirement Quant analysis functions, such as Retirement Income and Retirement Age. Once you understand your baseline plan, it is easy to modify your retirement strategies.

Be sure to save your profile before leaving the Edit/Create Profile dialog box.

Running Analyses From

the main Retirement Quant dialog box, you can view your cash flow, net worth,

and

perform

what-ifs by clicking on the buttons for the various analyses.

The analyses allow you to perform quick what-ifs by changing an input and

running a simulation. You can also perform what-if’s by clicking on

Retirement Strategies in most windows and re-running a simulation. This is where

you may want to apply different decision rules and

see the effect.

You can print any analysis individually as well as print a

complete summary of your profile and the analyses of your choice.

Retirement QuantNews Contact Us FAQ How to Order