|

|

|

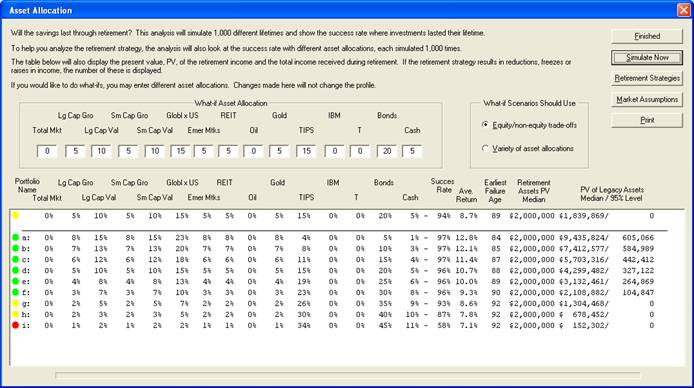

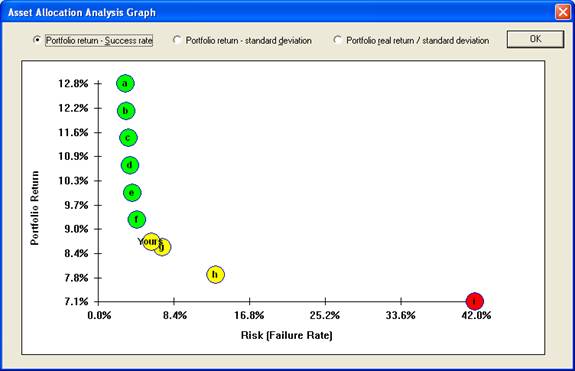

The output of the analysis shows not only the success rate of the proposed allocation but also the earliest age at which a simulation failed. This gives further information on the level of risk. Retirement Quant allows you to evaluate the strategy in-depth. You will see the projected final income levels and total retirement income. Both the median values and the 95% confidence levels are shown to further help you evaluate the risk of the proposed strategy.

|

||||||

| Approach | ||||||

| Notes | ||||||

| How it Works | ||||||

| Sample Profiles | ||||||

| In the News | ||||||

| How to Order | ||||||

| Publications | ||||||

| Management | ||||||

| FAQ | ||||||

|

© 2007 B-K-Ind LLC, All Rights Reserved |